Seliphar Musungu, Kakamega

Kenya launched the hustler fund, a digital financial initiative designed to offer capital to small businesses and encourage saving, late November last year. The fund is in line with President William Ruto’s campaign pledge to promote entrepreneurship and address unemployment. The phrase “hustler” was coined to resonate with most Kenyans living below the poverty line and mainly in the informal sector.

Speaking at its launch the President said the government will capitalize on the fund and will allocate kshs50 billion a year over the next five years. “We are establishing a culture of saving investment and social security,” the President said.

According to state house spokesperson Hussein Mohammed as posted in his Twitter handle, about 18 million Kenyans had borrowed Kshs14 billion and saved about kshs700 million by the end of last December, a month into its launch.

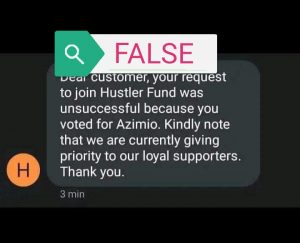

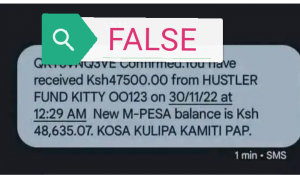

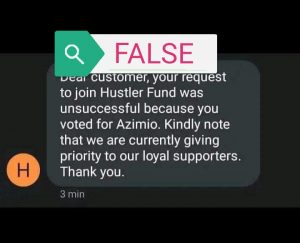

Despite the impressive figures, the fund is dogged by unverified information which include, revealing of one’s Mpesa pin hence exposing one’s details to the financiers, that only political supporters of the President can access the fund, amidst other claims, contributing to skepticism, particularly in rural Kenya.

Kakamega town, a cosmopolitan area, which had supporters across the political divide, is a host to such claims.

Julius Owino is one of the Kakamega residents who have been made to believe that as a supporter of the Presidents’ rival party at the polls Azimio la Umoja he would not be able to access the fund.

Owino claims that when he registered for the loan immediately it was launched, he was told to wait two hours to receive the registration message, to allow him to proceed to borrow, he claims it has been over a month of waiting.

“I was happy when the President launched the hustler fund because I survive on hand-to-mouth kind of jobs and was in desperate need of capital. I tried to register and was told to wait for 2 hours for a message to confirm my hustler fund limit and then get the credit. Since November I am still waiting for the message,” said Owino

He added : “When I was going through my phone, I came across a message that said if you are an Azimio supporter you are not eligible for the loan, that surprised me because I am an Azimio supporter, and I even voted for Raila Odinga. What surprised me more is how they concluded that I supported Azimio and guessed it would have been because of my surname”

Owino explains that the message discouraged him from going for the fund and he has not tried applying for the fund again.

“I was so discouraged and disappointed and to my surprise, a close friend who is also an Azimio supporter went through a similar experience, receiving the same message that was in circulation. What does that mean? Are Azimio supporters not allowed to access the fund?” We believed the message and we gave up on trying again to get the hustler fund,” Owino said

Others have met success when applying for the fund. Lilian Waluke is a hawker in the outskirts of the town; she sells biscuits, sweets, and firewood. She confirms she received kshs1000 from the fund, which enabled her to start the business.

“I thank the President for fulfilling his promise to Kenyans. I registered and a confirmation message was sent to me, confirming my limit which was 1000/= I didn’t hesitate I took the fund and decided to start a small business. I opted for biscuits, sweets, and firewood. Am glad that my business is picking up. I have customers and at least some profits.” said Waluke.

However, she says her initial plan to repay the loan in good time for a good credit record are now on hold. This follows claims by the businesspeople around her, that one risks jail of their choice, if unable to repay. Lillian claims that the message was sent to people via phone, and this has discouraged her from any plans to re-borrow.

“I had intentions of growing my limit and getting more money from the hustler fund, but I won’t be able to do that because what if I fail to repay the loan? What if I incur losses and the business becomes unprofitable? I have decided not to take hustler funds anymore because my fellow business ladies told me those who default will be jailed. The message is circulating to those who received the loans. We have decided not to re-apply for the funds and will opt for loans from other platforms,” said Waluke

These messages have sent panic and mixed reactions from a section of Kenyans, creating confusion about the fund. Many are afraid to borrow for fear of a jail term in the event they default. The political rivalry seems to deepen with Azimio supporters feeling Kenya Kwanza supporters are favored despite also being taxpayers.

The President while launching the fund is quoted saying the fund will be accessible to all.

“Every Kenyan will be allowed to access the hustler fund, no one will be excluded. As Kenyans let’s use this chance well and let’s not abuse it, no matter your credit history, you will access the hustler fund,” said Ruto.

Data Privacy implications are also of concern as claims circulate that one reveals their Mpesa pin to access the fund. John Walubengo an ICT lecturer and consultant in a recent post on the KICTANet website questioned whether the fund is operating within the data protection laws. In his article, he opines that fund management is collecting the personal data of Kenyans and hence must be registered as a Data controller or a data processor. He also points out the need for clarity regarding which ministry the fund falls under as currently, it is not clear whether it is run under the Ministry of Finance, Cooperatives, or another government agency.

The lack of clarity saw attempts to get clear information from the Kakamega County Commissioner’s office and the chief prove futile as both offices were reluctant to comment on the fund.

Lack of clear and authoritative data on the hustler fund allows room for unverified reports and disinformation which work to discourage potential borrowers.

END