Bungoma

By Godfrey Wamalwa

Ng’arisha Sacco journey that started 41 years ago with a handful of members now stand as towering financial figure in the Kenyan cooperative movement.

With a strong asset base of over Ksh.1 billion and a membership of over 15,000, the Sacco now tops financial institutions that contribute to the livelihoods of many of our members and the national economy.

Led by the board chairperson, Mr.Benedict Simiyu who has a clear-cut vision. The Ng’arisha Sacco Chairman envisages a financially strong institution and prosperous members.

His distinct plans include taking Ng’arisha Sacco to the top tier co-operative and assisting members to grow their financial investments.

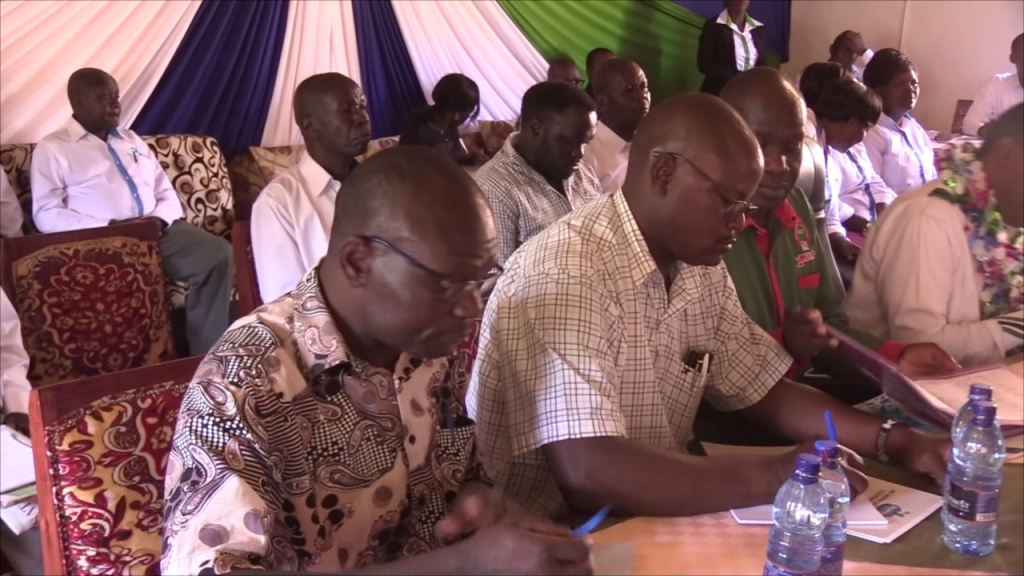

“We had to ensure all our staffs in all our satellite branches were qualified. We also started to implement performance management system. Our employees work on targets that they must deliver within the stipulated time,” said Mr Simiyu.

But Mr Simiyu is not an overambitious person; he has trained sights on a pragmatic approach. To achieve the goals, he is rallying his team to support the efforts to make the leading Sacco in the country.

The Sacco is setting an indelible mark in provision of financial and non-financial services.

“We had to ensure all our staffs in all our satellite branches were qualified. We also started to implement performance management system. Our employees work on targets that they must deliver within the stipulated time,” said Mr Simiyu. For him service delivery should never be comprised.

When you meet him,Macklins Wamukota, , the Chief Executive Officer is crisp precise and articulate on the strategic development plan for the Sacco he has in the coming years.

Mr.Wamukota cuts a figure of a man on a defined mission. Through his guidance and the board leadership, Ng’arisha Sacco has so far come a long way both in financial performance and members’ livelihood transformation.

The pioneer sacco in Bungoma County, which represents financial freedom and empowerment, plans to have a members of over 20,000 in the coming few years.

The 41 -years-old sacco, which has withstood the test of turbulent financial times that has seen many saccos split and collapse, is still going strong.

The sacco has grown to become one of the biggest indigenous financial institutions in western region and its environs.

The sacco whose headquarters is at Bungoma town in Kanduyi Sub-County, is situated at the multimillion-shilling Teachers Plaza built from members’ savings.

As the sacco became the preferred financial provider due to its improved services pegged on quality, integrity, professionalism, innovation and good customer service, the Sacco attracted more members from the neighboring counties.

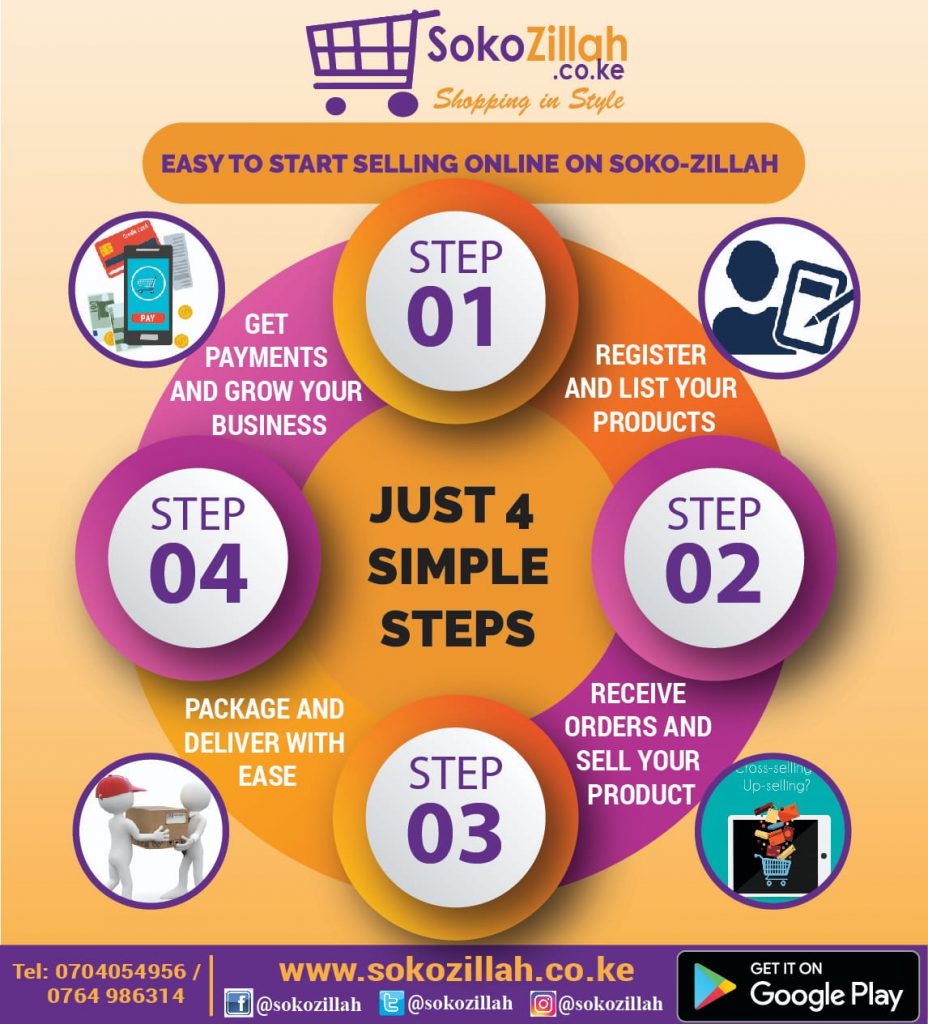

In 2014,it was rebranded from Bungoma Teachers Sacco Society limited to Ngarisha Sacco.The sacco, which is led by Mr.Macklins Wamukota, it has attracted workers in Bungoma County, Ministry of Education and the business community

This move saw the sacco cast net far and wide and attract members and partners nationally and internationally. The members could not be served due to its initial name and geographical location.

Ngarisha Sacco came up at a time when banks had shunned the region and most residents in rural Bungoma did not own bank accounts.

The sacco chairperson Benedict Simiyu said the Sacco won the confidence of mama mboga, teachers, jua kali operators among others who entrusted the Sacco with their money and supported it in a big way.

“Due to good governance and accountability which guaranteed the safety of members’ savings, the confidence grew tremendously as they supported the sacco by increasing their savings in a big way,” posed Mr.Simiyu.

Ng’arisha Sacco Net loans at 31st December 2018 and December 2019 stood at Sh1,744,152,970.46 and Sh1,779,325,706.00 at both Fosa and Bosa counters.

“The Sacco closed the year (2019) with the net loan balance to members of Sh1,927,019, 627 while it was Sh1,776,645.40 in 2018,” said Simiyu during annual delagates meeting.

The Sacco has generated an income of Sh72,443,449.77 with a surplus of Sh65,995,458.35.

Ng’arisha sacco formerly Bungoma

eachers sacco was established in 1979 currently offering loans to people in the Juakali sector, boda boda ,

Mama Mboga’s and cadres of investors basing on

their share

strength.

Ends